Who Qualifies For Property Tax Exemption . Scenario and type of property tax relief. To cushion the impact of the pt increases,. Section 6(6) of the property tax act provides exemption from payment of. It is not a tax on rental income. Web how to claim a property tax exemption. It is thus levied on the. You must own the property, and it must be your primary residence. 1 jan 2024 to 31 dec 2024. For properties which are used for exclusively charitable. Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. Property tax is an asset tax levied on property ownership. Web all registered charities will enjoy automatic income tax exemption. Web the eligibility criteria are as follows: If there is a property tax exemption you think you may qualify for, there are a few short steps to take to. Web eligibility conditions for exemption.

from www.templateroller.com

To cushion the impact of the pt increases,. You must own the property, and it must be your primary residence. Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. If there is a property tax exemption you think you may qualify for, there are a few short steps to take to. Scenario and type of property tax relief. It is not a tax on rental income. Web the eligibility criteria are as follows: Section 6(6) of the property tax act provides exemption from payment of. Web how to claim a property tax exemption. It is thus levied on the.

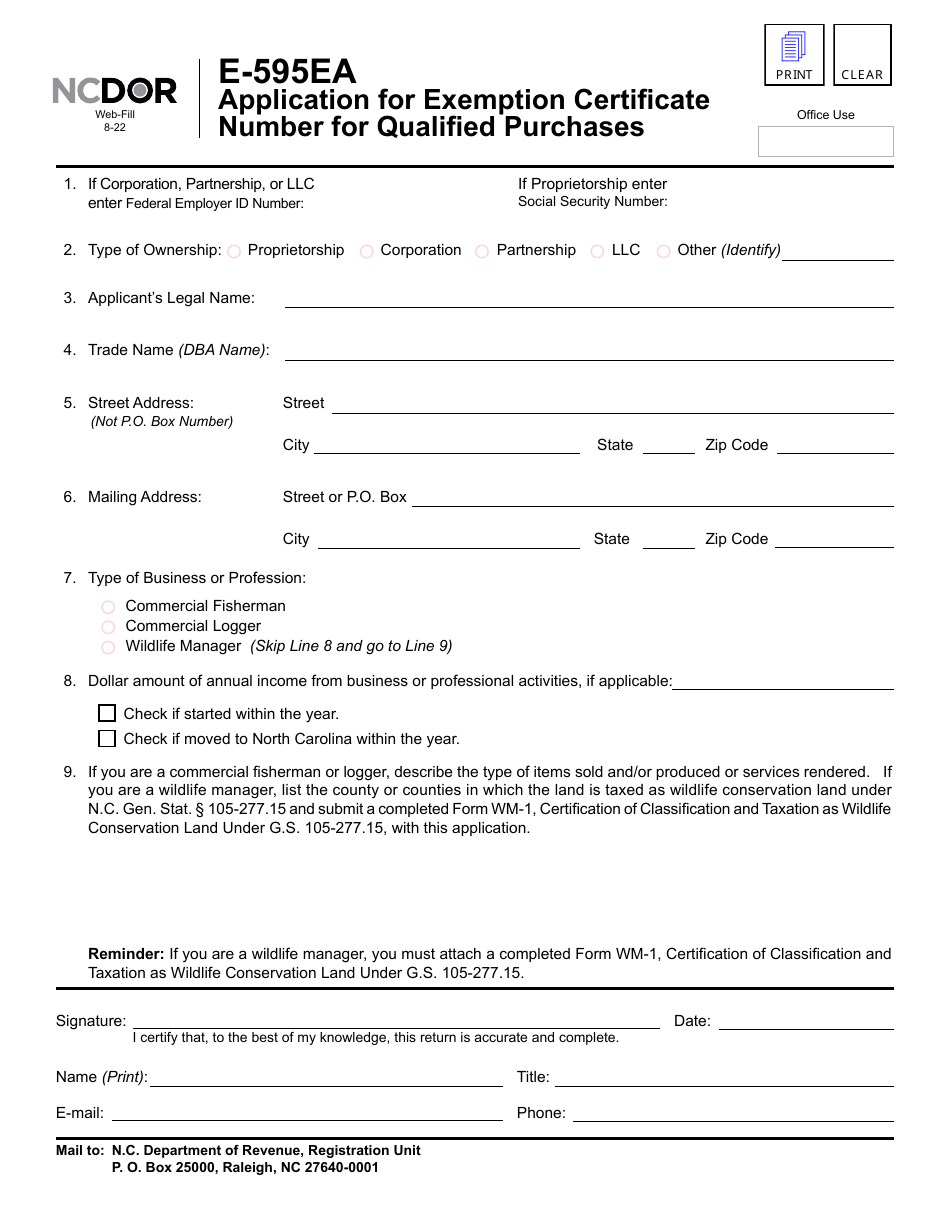

Form E595EA Download Fillable PDF or Fill Online Application for

Who Qualifies For Property Tax Exemption You must own the property, and it must be your primary residence. It is not a tax on rental income. Web the eligibility criteria are as follows: 1 jan 2024 to 31 dec 2024. Section 6(6) of the property tax act provides exemption from payment of. To cushion the impact of the pt increases,. Web how to claim a property tax exemption. Web eligibility conditions for exemption. Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. For properties which are used for exclusively charitable. Scenario and type of property tax relief. Web all registered charities will enjoy automatic income tax exemption. You must own the property, and it must be your primary residence. It is thus levied on the. If there is a property tax exemption you think you may qualify for, there are a few short steps to take to. Property tax is an asset tax levied on property ownership.

From www.msn.com

Beware myths around capital gains tax exemption for a principal residence Who Qualifies For Property Tax Exemption To cushion the impact of the pt increases,. For properties which are used for exclusively charitable. Web the eligibility criteria are as follows: It is thus levied on the. Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. 1 jan 2024 to 31 dec 2024. Property tax is an. Who Qualifies For Property Tax Exemption.

From www.dexform.com

Application for real property tax exemption and remission (Ohio) in Who Qualifies For Property Tax Exemption Scenario and type of property tax relief. You must own the property, and it must be your primary residence. Web the eligibility criteria are as follows: If there is a property tax exemption you think you may qualify for, there are a few short steps to take to. Section 6(6) of the property tax act provides exemption from payment of.. Who Qualifies For Property Tax Exemption.

From www.youtube.com

Who qualifies for property tax exemption California? YouTube Who Qualifies For Property Tax Exemption Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. You must own the property, and it must be your primary residence. Scenario and type of property tax relief. Section 6(6) of the property tax act provides exemption from payment of. It is not a tax on rental income. It. Who Qualifies For Property Tax Exemption.

From advisorsavvy.com

Advisorsavvy Principal Residence Exemption Canada Who Qualifies For Property Tax Exemption You must own the property, and it must be your primary residence. Web how to claim a property tax exemption. Property tax is an asset tax levied on property ownership. Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. Scenario and type of property tax relief. 1 jan 2024. Who Qualifies For Property Tax Exemption.

From www.townofantigonish.ca

Low Property Tax Exemption Town News Who Qualifies For Property Tax Exemption Scenario and type of property tax relief. If there is a property tax exemption you think you may qualify for, there are a few short steps to take to. For properties which are used for exclusively charitable. Web all registered charities will enjoy automatic income tax exemption. Section 6(6) of the property tax act provides exemption from payment of. Web. Who Qualifies For Property Tax Exemption.

From www.formsbank.com

Long Form Property Tax Exemption For Seniors printable pdf download Who Qualifies For Property Tax Exemption Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. Web eligibility conditions for exemption. 1 jan 2024 to 31 dec 2024. Property tax is an asset tax levied on property ownership. It is thus levied on the. You must own the property, and it must be your primary residence.. Who Qualifies For Property Tax Exemption.

From www.youtube.com

Who Qualifies for a Property Tax Exemption? YouTube Who Qualifies For Property Tax Exemption Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. You must own the property, and it must be your primary residence. Web all registered charities will enjoy automatic income tax exemption. It is thus levied on the. Section 6(6) of the property tax act provides exemption from payment of.. Who Qualifies For Property Tax Exemption.

From www.exemptform.com

California Hotel Occupancy Tax Exemption Certificate Who Qualifies For Property Tax Exemption Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. Web the eligibility criteria are as follows: Web all registered charities will enjoy automatic income tax exemption. For properties which are used for exclusively charitable. Web eligibility conditions for exemption. Web how to claim a property tax exemption. Property tax. Who Qualifies For Property Tax Exemption.

From www.sampleforms.com

FREE 10+ Sample Tax Exemption Forms in PDF MS Word Who Qualifies For Property Tax Exemption You must own the property, and it must be your primary residence. Property tax is an asset tax levied on property ownership. Web eligibility conditions for exemption. Scenario and type of property tax relief. To cushion the impact of the pt increases,. Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable. Who Qualifies For Property Tax Exemption.

From cdtfa.ca.gov

SALES AND USE TAX REGULATIONS Article 3 Who Qualifies For Property Tax Exemption It is thus levied on the. To cushion the impact of the pt increases,. You must own the property, and it must be your primary residence. Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. Web eligibility conditions for exemption. Property tax is an asset tax levied on property. Who Qualifies For Property Tax Exemption.

From cuagodep.net

Who Qualifies For Tax Exemption A Comprehensive Guide Who Qualifies For Property Tax Exemption Property tax is an asset tax levied on property ownership. To cushion the impact of the pt increases,. Web the eligibility criteria are as follows: It is thus levied on the. If there is a property tax exemption you think you may qualify for, there are a few short steps to take to. 1 jan 2024 to 31 dec 2024.. Who Qualifies For Property Tax Exemption.

From www.thesummitexpress.com

Mismanaged idle SSS assets justifies tax exemption, says BMP Who Qualifies For Property Tax Exemption Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction off the taxable value on. You must own the property, and it must be your primary residence. 1 jan 2024 to 31 dec 2024. It is not a tax on rental income. If there is a property tax exemption you think you may qualify for,. Who Qualifies For Property Tax Exemption.

From iphonehtctouchthemebl82749.blogspot.com

Bupa Tax Exemption Form / Property Tax Exemption For Individuals For Who Qualifies For Property Tax Exemption To cushion the impact of the pt increases,. It is thus levied on the. Web the eligibility criteria are as follows: 1 jan 2024 to 31 dec 2024. Scenario and type of property tax relief. It is not a tax on rental income. Property tax is an asset tax levied on property ownership. If there is a property tax exemption. Who Qualifies For Property Tax Exemption.

From www.exemptform.com

Texas Fillable Tax Exemption Form Fill Out And Sign Printable PDF Who Qualifies For Property Tax Exemption If there is a property tax exemption you think you may qualify for, there are a few short steps to take to. Section 6(6) of the property tax act provides exemption from payment of. For properties which are used for exclusively charitable. You must own the property, and it must be your primary residence. It is not a tax on. Who Qualifies For Property Tax Exemption.

From www.charlescitypress.com

Senior homeowners urged to apply for new property tax exemption before Who Qualifies For Property Tax Exemption Section 6(6) of the property tax act provides exemption from payment of. It is thus levied on the. You must own the property, and it must be your primary residence. Scenario and type of property tax relief. To cushion the impact of the pt increases,. Web homeowners’ exemption is a statutory tax provision, which provides a homeowner a $7,000 reduction. Who Qualifies For Property Tax Exemption.

From www.justinlandisgroup.com

[Guide] Greater Atlanta and Property Tax Exemptions for Seniors Who Qualifies For Property Tax Exemption 1 jan 2024 to 31 dec 2024. If there is a property tax exemption you think you may qualify for, there are a few short steps to take to. Scenario and type of property tax relief. It is thus levied on the. Property tax is an asset tax levied on property ownership. Web homeowners’ exemption is a statutory tax provision,. Who Qualifies For Property Tax Exemption.

From www.templateroller.com

Michigan Property Tax Appeal Answer Form Principal Residence Who Qualifies For Property Tax Exemption If there is a property tax exemption you think you may qualify for, there are a few short steps to take to. Web eligibility conditions for exemption. Scenario and type of property tax relief. You must own the property, and it must be your primary residence. It is not a tax on rental income. It is thus levied on the.. Who Qualifies For Property Tax Exemption.

From www.silive.com

Enhanced STAR property tax exemption deadline approaching here’s who Who Qualifies For Property Tax Exemption To cushion the impact of the pt increases,. You must own the property, and it must be your primary residence. Web how to claim a property tax exemption. Scenario and type of property tax relief. It is not a tax on rental income. Property tax is an asset tax levied on property ownership. Web all registered charities will enjoy automatic. Who Qualifies For Property Tax Exemption.